For some time now, experts have been saying that the US economy is going to fall. Yes, the dollar will most likely fall, but this shouldn’t be as shocking as it seems. This is a part of the cycle of rising and falling empires that is well-described in Ray Dalio’s video Principles for Dealing with the Changing World Order. He shows us how this cycle has been going for hundreds, if not thousands, of years.

But how are we so sure the US Economy is going to fall?

To understand that, we will have to look at some History.

Right after World War II, the US rose to become the next world power. This change also made the US Dollar the world trade currency because it was stable at the time. This was the time the US Dollar was equated to gold in a way known as the Gold Standard. This gave the US the purchasing power to buy whatever they wish since they control the world trade currency and, hence, giving them control over the global market. This power that the US Dollar has led to out-sourcing and cheap labor.

Countries like India and China have to produce goods from their country and sell them to the US to get US Dollars, which they use to purchase their other necessities from other countries, like buying oil from Qatar. All of these countries depending on the US used any means possible to get as many US Dollars in their reserve banks. Most utilized people from the lower class to produce and export these goods, birthing cheap labor and bad labor laws in these countries.

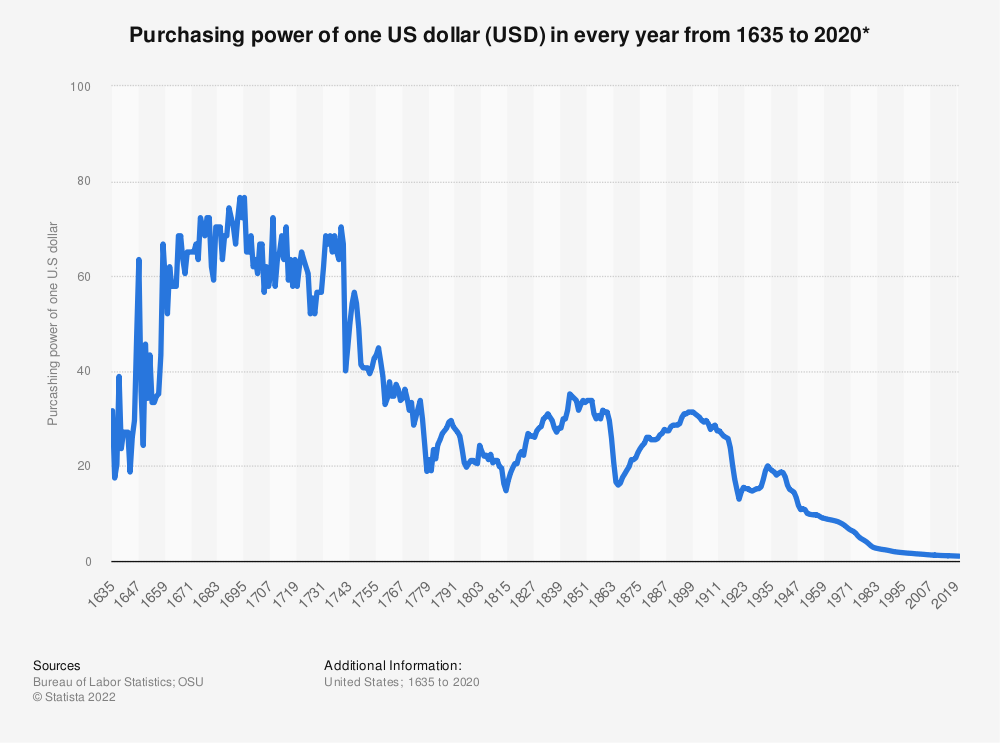

But lately, the Dollar has been on a downfall. In 1971, President Nixon eliminated the Gold Standard, meaning that the Dollar is no longer equated with gold. From here, the value of the Dollar is entirely dependent on the US Economy.

As the Dollar grew more powerful, more issues arose in the US, like a wider wealth gap and fewer jobs in the US due to out-sourcing, and when the US did not have enough money to fix these issues, they had to start printing currency and borrowing money, leading to inflation. This inflation led to trust issues with the US Dollar from other countries, and now, these other countries are slowly trying to move away from the Dollar.

The Cycle of Currency

This is the cycle described in Ray Dalio’s video. An empire rises when one falls. Its currency becomes the Reserve Currency. Slowly, internal problems arise in that country, leading to less trust from other countries. Eventually, some other country challenges this empire, causing conflict and war. In the end, the war marks the end of that empire and the beginning of a new one. This cycle has been and will keep going on for a very long time.

Ray Dalio’s video suggests that China will become the next world power after the US falls, but I believe something different. Recently, we are seeing a lot more bilateral trade agreements. Bilateral Trade Agreements are agreements between two or more to trade their goods using both currencies. Countries like India, China, and Russia have been trading with bilateral trade agreements instead of using the Dollar.

Also, not too long ago, 5 countries, Brazil, Russia, India, China, and South Africa, joined hands and introduced a new currency they will trade with known as the BRICS currency. Both the bilateral agreements and the BRICS currency lead me to believe that it won’t be one country’s currency controlling world trade. It will be a currency established by the whole world.

By: Sara Simon